Markets rotate between compression and expansion. A breakout should mark the start of expansion—but many breaks are just liquidity grabs: price pokes past a level, triggers stops, then reverses. In forex and crypto, thin liquidity windows, news spikes, and algorithmic hunting make traps common. This guide shows how to spot and filter false breakouts with testable rules you can automate, plus risk tactics to limit damage when traps slip through.

Related reading on Indicators101:

- How to Trade Breakouts in Forex (Techniques + Indicators)

- How to Trade Breakouts in Crypto Markets

- Risk Management 101: Position Sizing for Forex & Crypto

- How to Set Stop‑Loss & Take‑Profit in Forex

- How to Build & Backtest a Strategy in TradingView

Promise: You’ll learn the hallmarks of fake breaks, confirmation techniques, session/news filters, and two playbooks—retest confirmation and failed‑breakout reversal—with clear risk rules.

The Tell‑Tale Signs of a False Breakout

- No close beyond the level. Price wicks above/below and closes back inside the range or pattern.

- Lack of pre‑break compression. ATR is already high; ranges are wide. True expansions more often follow tight ranges.

- Momentum disagreement. MACD below zero on an upside “break,” or RSI < 50>

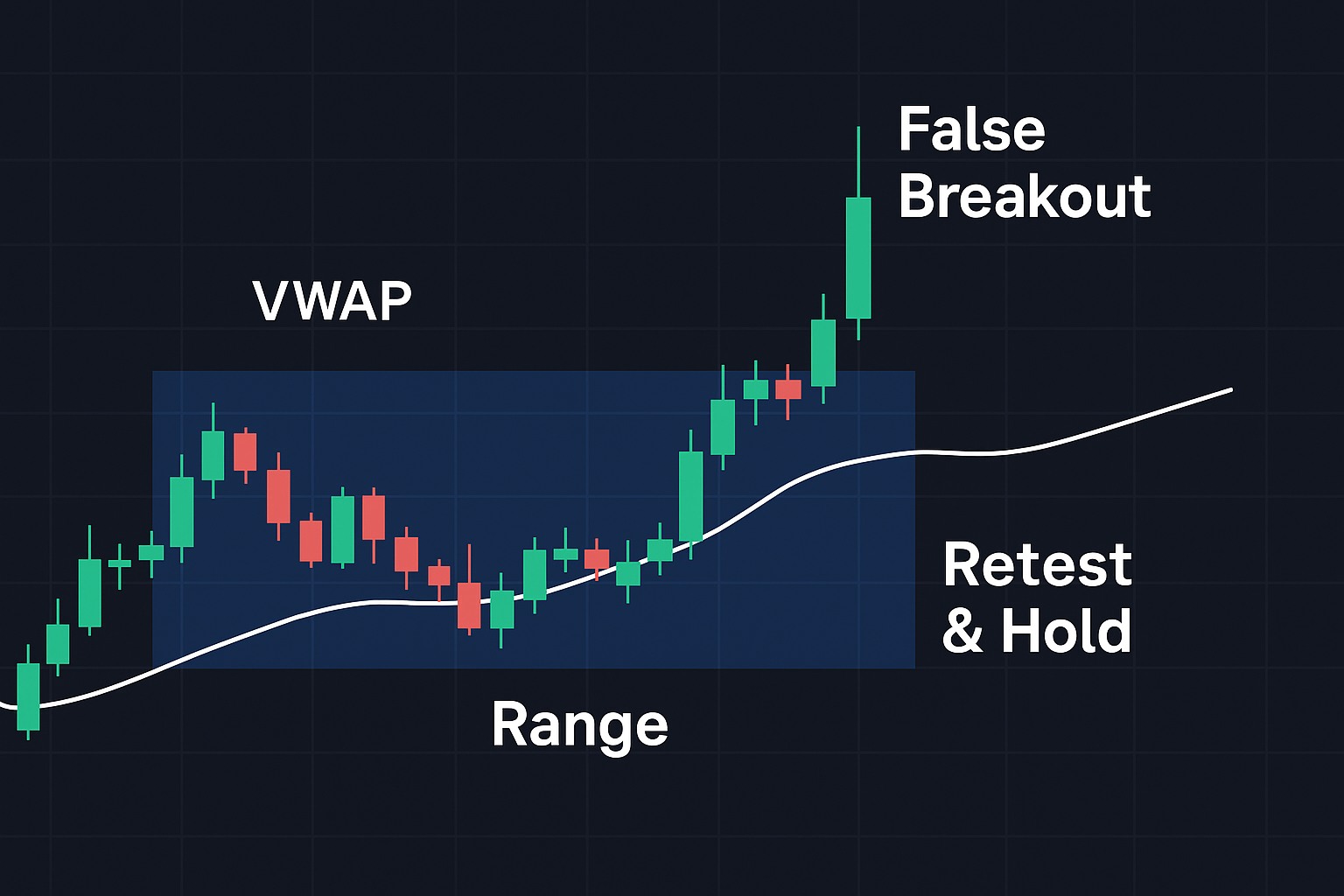

- Immediate reclaim of a reference. Price snaps back through VWAP, prior day high/low, or the broken level within 1–3 bars.

- Low/abnormal tick volume. On forex, weak tick volume relative to recent bars; on crypto, exchange volume below average.

- News‑timed spikes. Unsustainable moves around high‑impact events or one‑sided funding/positioning extremes (crypto).

If two or more of these appear, treat the break as suspect and demand extra confirmation.

Confirmation Techniques That Reduce Traps

Use one structure confirm + one momentum/volatility confirm. Keep it simple.

- Close‑Confirmation Rule Trade a breakout only on a confirmed candle close beyond the boundary (range high/low, inside bar, trendline). Avoid first‑tick entries.

- Retest & Hold After the close, wait for price to retest the broken level and hold (rejection candle). Enter on the retest close. This catches continuation while skipping many stop‑runs.

- ATR Compression Filter Require ATR(14) below its 20‑bar SMA before the break. If volatility is already expanded, pass.

- Momentum Bias For longs, require MACD line > 0 or RSI > 50 on/near the break. For shorts, invert.

- Session/Time Filter (Forex) Favor London/NY windows. Be cautious during Asia drifts and avoid 5–10 minutes around high‑impact releases.

- Funding/Volume Context (Crypto) Skip longs if funding is extremely positive and rising (crowded). Prefer breaks with above‑average volume.

- Multiple‑Break Trap Alert After 2–3 failed attempts at the same level in the same session, either stand aside or switch to a failed‑break reversal setup.

Risk Tactics for When You’re Wrong

- Place stops beyond structure + buffer. Opposite side of range/inside bar plus 0.3–0.7× ATR.

- Partial exits at +1.0–1.5R. Lock progress early; move stop to breakeven.

- Daily/weekly circuit breakers. Stop at −3R/day or −6R/week.

- Correlated exposure caps. Avoid stacking multiple pairs/coins driven by the same theme.

- Cool‑down rule. Two traps in a row? Pause for the session.

Playbook A — Breakout Retest Confirmation (Default Filter)

Idea: Only trade continuation after a confirmed close and a successful retest.

Rules (Long example):

- Structure: Range high, inside bar high, or prior day high.

- Filter: ATR(14) < SMA(ATR,20) before the break; RSI(14) > 50 at/near trigger.

- Trigger 1: Candle closes above the level.

- Trigger 2: Within 1–3 bars, price retests the level and prints a rejection close back upward.

- Entry: Close of the retest bar.

- Stop: Below rejection low − 0.5× ATR.

- Targets: 50% at +1.5R, trail remainder with 1.5× ATR or last swing.

- Guards: Skip 10 minutes before high‑impact news; avoid extremely positive funding for longs (crypto).

Why it avoids traps: Most stop‑runs lack a clean retest and sustained hold.

Playbook B — Failed‑Breakout Reversal (Fade the Trap)

Idea: When a breakout fails quickly—closing back inside and reclaiming VWAP/level—enter in the opposite direction.

Rules (Short example after false upside break):

- A candle closes back inside the prior range after wicking above it.

- Price reclaims VWAP or the broken level from above within 1–2 bars.

- Momentum confirm: MACD line < 0> or RSI < 50> on the reclaim bar.

- Entry: Close below VWAP/level.

- Stop: Above the failure wick high + 0.3–0.7× ATR.

- Targets: Range midpoint then opposite side (or +1.5R / +3R with optional ATR trail).

- Guards: Avoid thin hours and unexpected news; watch for sudden volume spikes against the position.

Why it works: Trapped breakout chasers must exit, fueling the reversal.

Indicator Stack (Lean & Testable)

- ATR(14): Compression filter and trailing stop engine.

- RSI(14) or MACD(12/26/9): Simple momentum bias/confirm.

- VWAP (intraday): Reclaim/failure logic and trade management anchor.

- Tick/Exchange Volume: Prefer breaks with relative volume; beware “silent” pokes.

Resist stacking indicators. Structure + ATR + (RSI or MACD) + VWAP is sufficient for most traders.

Common False‑Break Patterns (What to Watch For)

- One‑bar spike: Long upper/lower wick beyond the level; close back inside.

- Three‑push pop: Multiple minor highs into resistance followed by a small breakout that dies—often distribution.

- News wick: Single candle with huge range exactly at a release time.

- Band ride without confirmation: Price walks outside Bollinger Bands but momentum stays weak; closes keep returning inside.

- Broadening highs/lows: Expanding triangle behavior where each break is quickly reversed.

Backtesting Your Filters (Simple Workflow)

- Write exact rules (closes, retests, ATR threshold, momentum bias, session windows). No hindsight.

- Model costs (spread/fees/slippage; add funding for perps). Breakouts slip more—be conservative.

- Test across regimes (quiet vs. volatile months, trend vs. range). Include crypto weekends if relevant.

- Out‑of‑sample/Walk‑forward: Optimize minimally; test unseen periods to avoid curve‑fit.

- Forward test 2–6 weeks on paper/tiny size. Compare expectancy (R/trade) and max drawdown to backtest.

Key metrics: Profit factor (>1.2), expectancy (R/trade), max DD, win rate vs. average R, trades/week.

Practical Examples (Numbers Included)

Example 1 — EURUSD M15 Retest Confirmation

- Equity $10,000; risk 1% ⇒ $100.

- Asian range high 1.0870 breaks on London open; ATR(M15) < ATR>

- Retest: Price tags 1.0870, closes bullish above.

- Stop: Retest low − 0.5× ATR (22 pips total). Size ≈ $100 ÷ 22 ≈ $4.55/pip (0.46 mini lots).

- TP1 +1.5R (33 pips), trail remainder 1.5× ATR.

Example 2 — BTCUSDT H1 Failed Break Reversal

- Topside wick beyond base; next bar closes back inside and below VWAP; MACD below zero.

- Equity $6,000; risk 0.5% ⇒ $30. Stop 0.9% above entry; leverage 3×.

- Notional = $30 × 3 ÷ 0.009 ≈ $10,000. TP1 at +1.5R; TP2 at range low or ATR trail.

Psychology & Process

- Patience over FOMO. Waiting for a retest can feel like “missing out.” It saves money.

- Pre‑commit to rules. Write them on a checklist; your future self will thank you after the third fake break.

- Review screenshots. Build a folder of true vs. false breaks. Pattern recognition compounds.

- Automate guardrails. Let bots enforce no‑trade windows, loss caps, and retest requirements.

FAQs

What’s the single best way to avoid false breakouts?

Require a confirmed close beyond the level and a retest that holds before entering.

Do I need volume for forex?

Spot volume is proxy‑based (tick). Use it comparatively; combine with ATR/momentum and session context.

Is it better to fade breakouts or wait for retests?

For most beginners, retests are safer. Fading failed breaks works—but only with strict rules.

What if the retest never comes?

Let it go. There will be another setup. Chasing is how traps get you.

Can I automate these filters?

Yes—Pine/MQL/Python can code closes, retests, ATR thresholds, momentum confirms, and VWAP reclaims.

Summary & Next Steps

False breakouts are part of trading. You can’t avoid every trap, but you can avoid most by demanding close confirmation, a retest and hold, compression before expansion, and a momentum bias—backed by firm risk rules. Code the rules, test across regimes, and use automation to remove hesitation.

Call to Action: Ready to filter traps and trade with confidence? Give our Indicators a try at AITradingSignals.co to spot compression, retests, and momentum confirms—plus ATR‑based exits. Prefer a guided path?

Check out our courses at aitradingsignals.gumroad.com for backtesting labs and step‑by‑step playbooks.

Compliance & Disclaimer: This educational material is not investment advice. Trading involves risk, including possible loss of principal. Past performance does not guarantee future results. Ensure images/charts you publish are original or licensed.