Crypto doesn’t move in straight lines. It pulses through expansion and contraction, risk‑on and risk‑off. Recognizing where we are in the cycle helps you pick strategies, position sizes, and expectations that fit the moment. This guide gives you an actionable framework—signals to watch, behaviors to expect, and rules‑based playbooks you can backtest and automate with algorithmic/AI tools.

Related reading on Indicators101:

- How to Trade Breakouts in Crypto Markets

- Indicators101: Beginner’s Guide to Algorithmic Trading

- Risk Management 101: Position Sizing for Forex & Crypto

- Identifying False Breakouts: Tips to Avoid Traps

Promise: You’ll leave with cycle definitions, objective indicators, strategies for each phase, and risk controls—minus the hype.

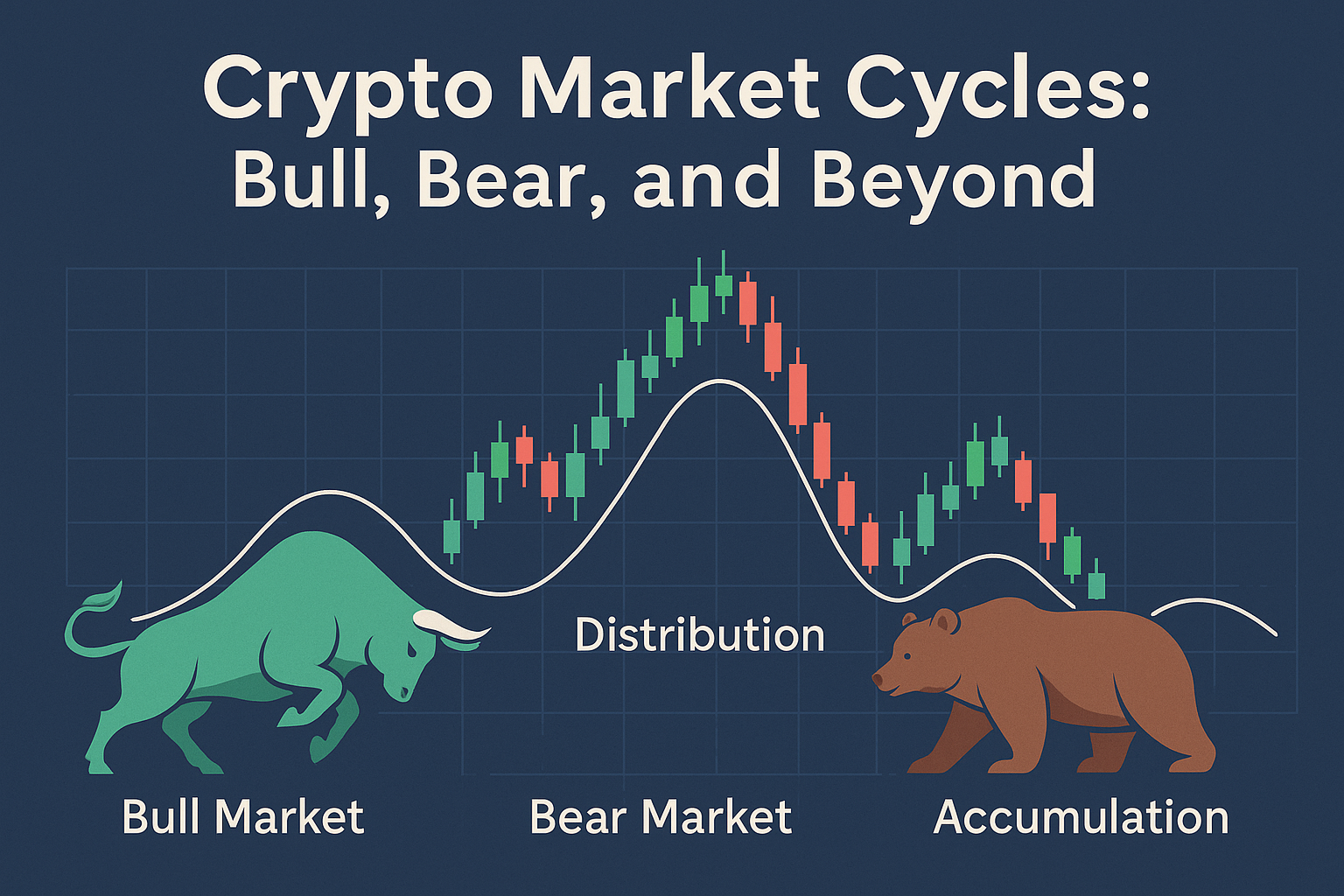

The Core Cycle Model (Simple, Practical)

We’ll use four broad phases. They’re heuristics—not perfect clocks.

- Accumulation (Late Bear → Early Bull) Price bases after a downtrend; volatility and narrative interest are low. Smart money accumulates gradually.

- Uptrend/Bull Expansion Breakouts hold; higher highs/lows form; breadth improves; pullbacks are shallow and bought quickly.

- Distribution/Blow‑Off Parabolic moves, extreme sentiment, rising funding/leverage; divergences creep in; volatility expands.

- Downtrend/Bear Contraction Lower highs/lows; failed rallies; news is punished; liquidity dries up; ranges grind lower until value is found.

Cycles rhyme across BTC, ETH, and alts—but timing differs. Treat BTC as a regime setter and alts as beta multipliers.

How to Identify Each Phase (Objective Signals)

Use a stack of simple, testable indicators.

Trend structure:

- Bullish when price > 200‑day SMA and 50‑day > 200‑day; bearish when below.

- On H4/D1, look for higher‑high/higher‑low or lower‑high/lower‑low sequences.

Volatility:

- ATR percentile vs. 6–12 months. Accumulation = low ATR; blow‑offs = rising ATR and wide candles.

Breadth & leadership:

- of majors above their 50‑day MA; alts following BTC or lagging.

Derivatives context:

- Funding and open interest. Overheated when funding stays strongly positive with rising OI; stressed when negative funding persists.

On‑chain/flow (context, not triggers):

- Exchange reserves (downtrend supportive), ETF/spot flows, realized profits vs. losses.

Typical Behaviors by Phase (What to Expect)

Accumulation

- Basing patterns; Bollinger squeezes; fake breaks common.

- Best tactics: base breakouts on confirmed closes, retest entries, DCA for investors.

Uptrend/Bull

- Breakouts work; pullbacks shallow; momentum confirms.

- Best tactics: trend pullbacks (RSI 50 re‑cross), base breakouts with MACD/ROC confirmation, ATR trails to ride outliers.

Distribution/Blow‑Off

- Extreme funding/sentiment; expanding intraday ranges; failed breakouts increase.

- Best tactics: scale‑outs, tighter ATR trails, reduce leverage, watch for failed‑break reversals.

Downtrend/Bear

- Rallies fail at MAs; breakdowns continue; volume prioritizes exits.

- Best tactics: trade short setups only if your venue and rules allow; otherwise focus on capital preservation, range fades, and building watchlists.

Strategies & Rules for Each Phase

A) Accumulation — Base Breakout + Retest (D1/H4)

- Identify: 10–40 bar base; ATR(14) below its 20‑bar SMA.

- Trigger: Close outside the base and momentum confirm (MACD > 0 or ROC(10) > +0.3% for longs).

- Retest entry: Prefer a quick retest/hold of the broken level.

- Stop: Base low − 0.5× ATR.

- Targets: 1× and 2× base height; trail remainder with 1.5× ATR.

- Risk: 0.5% per trade on BTC/ETH; 0.25% on alts.

B) Bull Expansion — Trend Pullback + RSI Re‑Cross (H1–D1)

- Bias: 50‑day > 200‑day (or 50EMA>200EMA on your timeframe).

- Setup: Pullback to 20 EMA or prior swing; RSI drops to 40–50.

- Trigger: RSI(14) re‑cross above 50 and a bullish close.

- Stop: Swing low − 1× ATR.

- Targets: Partial at +1.5R; runner with 1.5× ATR trail.

- Guards: No new entries 15 minutes before major news.

C) Distribution — Failed‑Break Reversal (H1/H4)

- Clues: Funding elevated; MACD divergences; frequent fake‑outs.

- Trigger: Wick beyond resistance; close back inside the range; VWAP reclaim.

- Entry: Close below VWAP/level (for shorts) with MACD < 0>

- Stop: Above failure wick + 0.5× ATR.

- Targets: Range midpoint then opposite side; optional +1.5R/+3R plan.

- Risk: Smaller size; use daily loss caps.

D) Bear Contraction — Range Fade with Tight Risk (H1)

- Bias: Below 200‑day; rallies sold.

- Setup: Well‑defined intraday range.

- Trigger: Fade edges only with RSI divergence and low ATR; exit aggressively.

- Stop: Outside the range + small buffer.

- Targets: Range mid and opposite edge. Stand aside on news.

Position Sizing & Exposure Caps (Phase‑Aware)

- Per‑trade risk: BTC/ETH 0.5%–1.0% (reduce in distribution/bear); alts 0.25%–0.75%.

- Total open risk cap: ≤ 3% across positions.

- Correlation cap: Not more than two highly correlated alts at once; prefer BTC/ETH as core.

- Circuit breakers: −3R/day or −6R/week; pause and review before resuming.

Indicators That Work Across Phases (Keep It Lean)

- ATR (14): Compression filter and trailing stop engine.

- MACD (12/26/9) or ROC (10): Momentum confirmation on breakouts.

- RSI (14): 50‑level as trend/pullback trigger; divergences as early warnings.

- VWAP (intraday): Reclaim/failure logic during distribution.

Structure + ATR + one momentum tool (MACD/ROC/RSI) + VWAP intraday is enough for most systems.

Managing Psychology Through the Cycle

- Accumulation: Boredom breeds over‑tweaking. Journal, collect screenshots, and wait for confirmation.

- Bull: FOMO pushes you to increase size. Pre‑define size caps and stick to partials.

- Distribution: Euphoria flips to doubt fast. Use checklists; reduce leverage.

- Bear: Despair tempts revenge trading. Shrink size or stand aside; focus on research and system upgrades.

Backtesting Your Cycle Playbooks

- Define rules first (entries, exits, filters). Avoid peeking.

- Model costs accurately (fees, slippage, funding for perps).

- Test across regimes—include bull, bear, and sideways months; use multiple assets (BTC, ETH, liquid alts).

- Out‑of‑sample: lock parameters on one period, evaluate on another.

- Forward test on paper or micro size for 2–6 weeks.

Key metrics: Profit factor (>1.2), expectancy (R/trade), max drawdown, time to recovery, and trades per week.

Putting It Together: A Simple Cycle‑Aware Plan

- Maintain a Spot Core (DCA) you rarely touch.

- Layer Tactical Trades based on the current phase:

-

- Accumulation: base breakouts & retests.

- Bull: trend pullbacks & continuation.

- Distribution: reduce risk; hunt failed breaks.

- Bear: defense first; range fades tiny size or stand aside.

- Use a risk router (manual rules or algo) to enforce per‑trade risk, correlation caps, and circuit breakers.

- Review weekly: phase checklist, leading/lagging assets, funding/volume context, rule compliance.

FAQs

How do I know when a bull turns to distribution?

Look for parabolic pushes with rising ATR, elevated funding, and momentum divergences. Start scaling out and tighten trails.

Do cycle indicators work on alts?

Yes, but slippage is worse and regimes shift faster. Use smaller risk and stricter liquidity filters.

Is it worth trading during bear markets?

Only with a proven short or range strategy and tight risk. Otherwise, focus on research and protecting capital.

Can I automate a cycle strategy?

Yes. Encode phase detection (trend + ATR percentile + funding thresholds) and switch playbooks automatically; keep human oversight.

What timeframe is best for cycle analysis?

Use weekly/daily to identify the phase, then execute on H4/H1 or M30 for entries.

Summary & Next Steps

Crypto cycles are noisy but not random. Combine structure, volatility, momentum, and derivatives context to label the phase—then run the matching playbook with consistent risk. Backtest across regimes, forward test small, and let algorithmic trading enforce the rules.

Call to Action: Ready to align your tactics with the cycle? Give our Indicators a try at AITradingSignals.co to spot squeezes, momentum confirms, and ATR‑based trails. Prefer a guided path?

Check out our courses at aitradingsignals.gumroad.com for step‑by‑step playbooks and backtesting labs.

Compliance & Disclaimer: This educational material is not investment advice. Crypto trading involves risk, including possible loss of principal. Past performance does not guarantee future results. Publish only original or licensed images/charts.