Bitcoin doesn’t move randomly. It follows a powerful rhythm tied to a fixed event: the halving. Every four years, Bitcoin’s block reward gets cut in half — a programmed moment that has historically triggered massive shifts in price, sentiment, and opportunity.

In this guide, you’ll learn how the cycle works, why the halving matters, and how traders use it to time their moves in the crypto market.

🕟 What Is Bitcoin’s Four-Year Cycle?

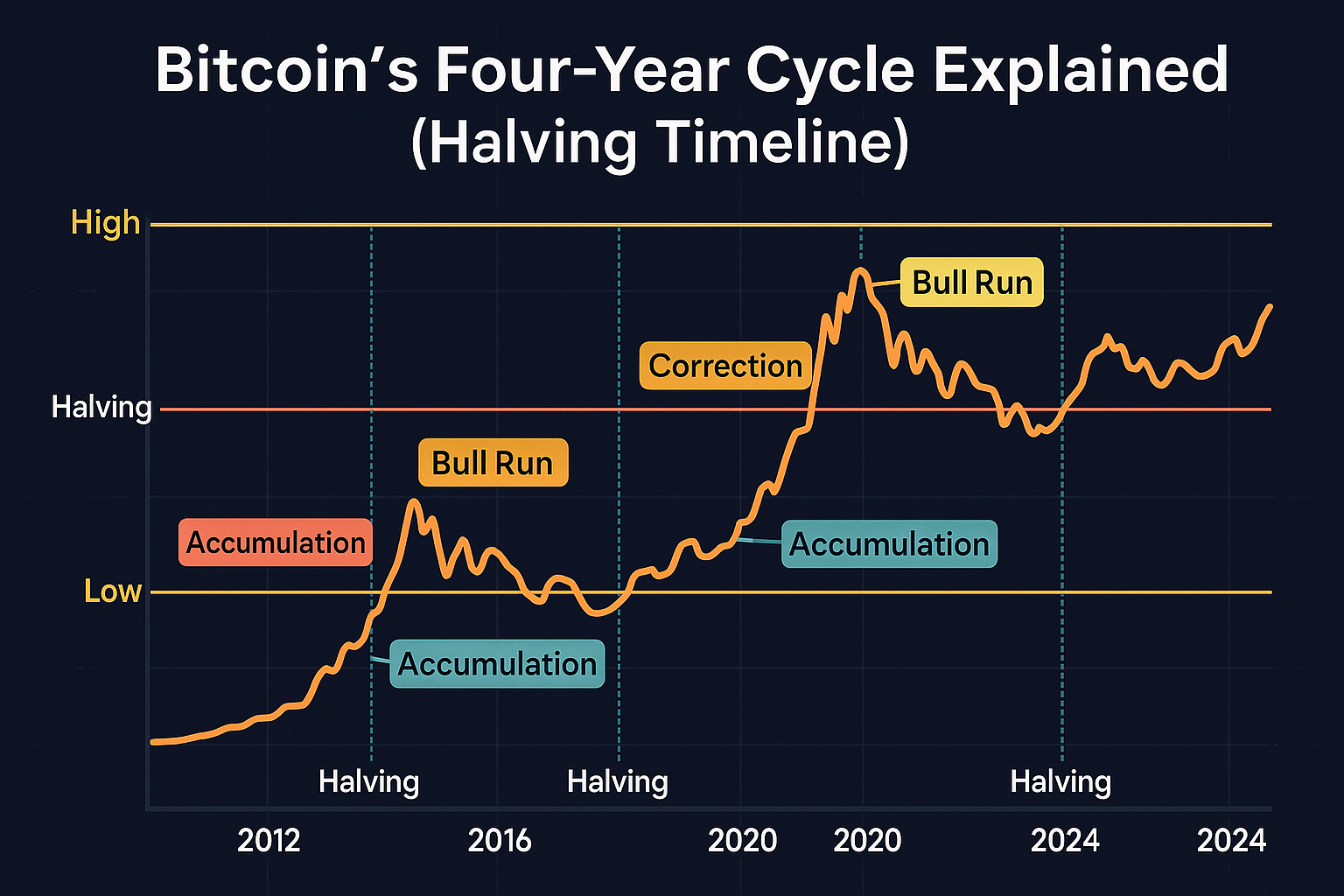

Bitcoin’s four-year cycle refers to a repeating pattern driven by the halving event, which happens roughly every four years. This cycle tends to unfold in four phases:

- Accumulation Phase (post-crash recovery)

- Bull Market Phase (accelerating gains)

- Blow-Off Top Phase (parabolic price movement)

- Correction/Bear Phase (sharp decline and long cooldown)

These phases aren’t arbitrary. They line up remarkably well with the halving schedule.

⚒️ What Is the Bitcoin Halving?

To understand the cycle, you need to know about the halving.

Quick Breakdown:

- Bitcoin miners earn rewards by validating transactions.

- Every 210,000 blocks (~4 years), that reward is cut in half.

- This reduces the rate at which new Bitcoin enters circulation.

The halving is Bitcoin’s version of a “scarcity trigger” — fewer coins being mined makes Bitcoin more scarce. And that often leads to higher prices over time.

Why It Matters:

- Slows down Bitcoin supply

- Keeps inflation in check

- Creates predictable supply shocks that drive long-term price trends

🗓️ Bitcoin Halving Timeline: Past and Future

Here’s how Bitcoin has performed after each halving event:

✨ 2012 Halving

- Date: November 28, 2012

- Price at Halving: ~$12

- Peak After: ~$1,150 in Dec 2013

✨ 2016 Halving

- Date: July 9, 2016

- Price at Halving: ~$650

- Peak After: ~$20,000 in Dec 2017

✨ 2020 Halving

- Date: May 11, 2020

- Price at Halving: ~$9,000

- Peak After: ~$69,000 in Nov 2021

🕒 2024 Halving (Upcoming)

- Estimated Date: April 2024

- Block Reward Drops: From 6.25 BTC to 3.125 BTC

- Outlook: Market anticipates strong upward pressure, though volatility remains high

📈 How the Cycle Affects Market Behavior

Each phase of the cycle comes with unique trader psychology:

✅ Year 1: Post-Halving Accumulation

- Supply drops, but demand is quiet

- Prices slowly recover

- Best time to start dollar-cost averaging (DCA)

🌟 Year 2: Bull Run Begins

- Momentum builds

- Media starts covering Bitcoin again

- Prices accelerate quickly

⚡ Year 3: Parabolic Hype Phase

- New all-time highs

- Massive retail inflow and FOMO

- Often ends in a blow-off top

❌ Year 4: Correction and Bear Market

- Prices drop 70–90%

- Sentiment turns fearful

- Smart money re-enters for the next cycle

🤓 How Traders Use the Halving Cycle

Timing Entries

Savvy traders accumulate during post-halving lulls and aim to take profits during late bull markets.

Using Tools and Signals

Indicators like RSI, Moving Averages, and Volume help time entries and exits. Better yet, platforms like AITradingSignals.co use AI to combine multiple indicators and flag cycle-based opportunities.

Risk Management

Understanding the cycle helps avoid buying at the top and panic selling at the bottom.

🌎 Macro Factors That Influence the Cycle

While the halving plays a huge role, it’s not the only factor driving Bitcoin’s price. Smart traders also watch for:

- Interest rates: Rising rates often cool risk assets

- Regulatory news: Government policies can impact demand

- Stock market trends: Bitcoin often correlates with broader markets in high volatility periods

- Global liquidity: More liquidity = more risk-taking = bullish for crypto

These external forces can amplify or dampen the cycle’s effects.

❌ Common Mistakes During Each Cycle Phase

During Accumulation:

- Ignoring the market

- Assuming Bitcoin is “dead”

During Bull Run:

- Entering late

- Chasing green candles without a plan

During Parabolic Phase:

- Not taking profits

- Letting emotions override risk management

During Bear Market:

- Panic selling

- Refusing to DCA back in when prices are low

Learning to expect and prepare for these phases is what separates smart traders from emotional ones.

❓ FAQs: Bitcoin Halving and Market Cycles

Q: Does the halving guarantee a bull market?

A: No, but historically it has preceded major price rallies. Other factors like macroeconomics still play a role.

Q: How long does the post-halving bull run last?

A: Typically 12–18 months after the halving.

Q: What should I do before a halving?

A: Accumulate gradually, plan your risk strategy, and watch sentiment. AI tools can help refine timing.

Q: Is it too late to buy after the halving?

A: Not necessarily. Year 1 often offers a long runway before the parabolic phase begins.

Q: Will each halving cycle be smaller than the last?

A: Possibly. As Bitcoin matures, its volatility and returns may gradually decline. But cycles still matter for timing and psychology.

Q: Do altcoins follow Bitcoin’s halving cycle?

A: Often, yes. Many altcoins rally after Bitcoin leads the charge in a post-halving bull run.

🚀 Final Thoughts: Trade Smarter with the Cycle in Mind

Bitcoin’s four-year cycle isn’t just a pattern — it’s a strategic framework. Understanding where we are in that cycle can help you:

-

Time your entries with greater precision

-

Manage risk before the crowd reacts

-

Stay grounded and avoid emotional trading

But timing the cycle manually takes time and experience — and in fast-moving markets, speed is everything.

That’s why we built AITradingSignals.co — to give traders like you real-time, AI-powered insights that adapt with the cycle and highlight high-probability setups automatically.

🔗 Get the full script, step-by-step guide, and market-specific tools (forex or crypto) via our site or Gumroad — and start making smarter decisions today.

This is one of the clearest and most straightforward explanations of Bitcoin’s four-year cycle I’ve ever read. You’ve done a fantastic job of demystifying the halving process and connecting it directly to market psychology. The timeline chart is especially helpful for visualizing the entire cycle. This is an invaluable resource for anyone trying to understand the fundamental rhythm of Bitcoin. Thanks for the great work!